Top 5 Candlestick Patterns for Trading Stock Indices

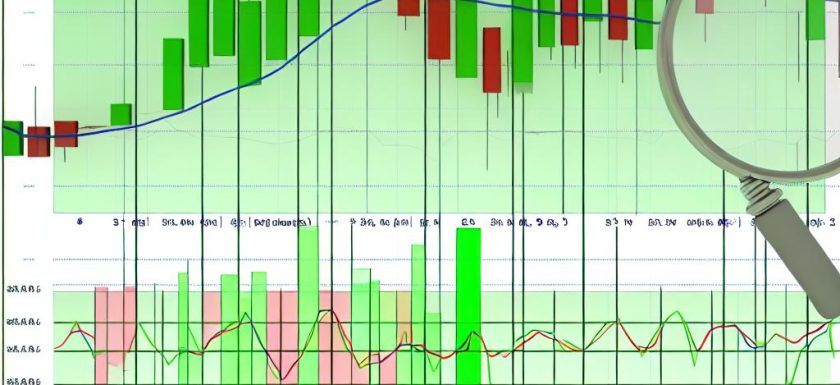

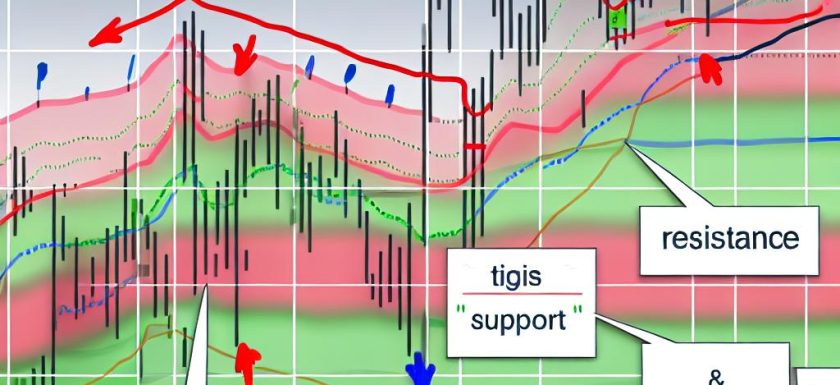

Introduction to Candlestick Patterns in Stock Indices Candlestick patterns are essential tools for traders analyzing stock indices. These patterns provide visual cues about market sentiment and potential future movements in the prices of indices like the S&P 500, Nasdaq, and Dow Jones. In this article, we will explore the top five candlestick patterns that are commonly used by traders in assessing stock indices. 1. Bullish Engulfing Pattern The bullish engulfing pattern occurs when a small bearish candle is followed by a larger bullish candle, completely engulfing the previous day’s body. This pattern suggests that the bulls have overtaken the bears, indicating potential upward momentum. TradersRead More →