How to Use Elliott Wave Theory in Index Trading

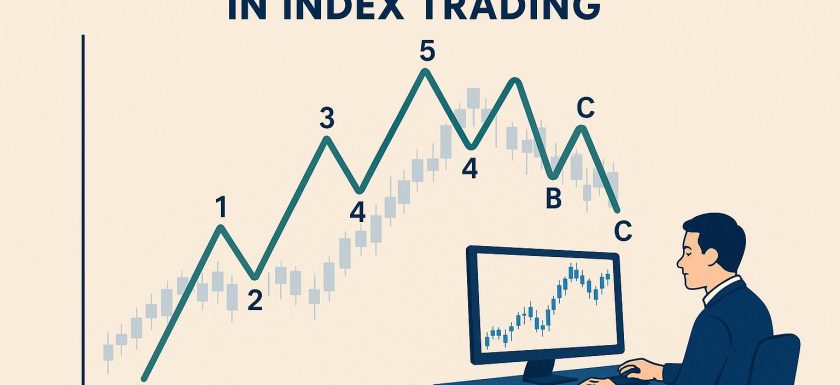

Understanding Elliott Wave Theory Elliott Wave Theory is a popular analytical approach used by traders to predict future price movements in the financial markets. Originally developed by Ralph Nelson Elliott in the 1930s, the theory is based on the belief that markets move in waves, which reflect the inherent psychology of the market participants. This approach can be particularly useful in index trading, where traders attempt to determine market direction and identify potential opportunities. In this article, we will delve deeper into the intricacies of Elliott Wave Theory, exploring its basic principles, practical applications, and the considerations traders must take into account when employing thisRead More →