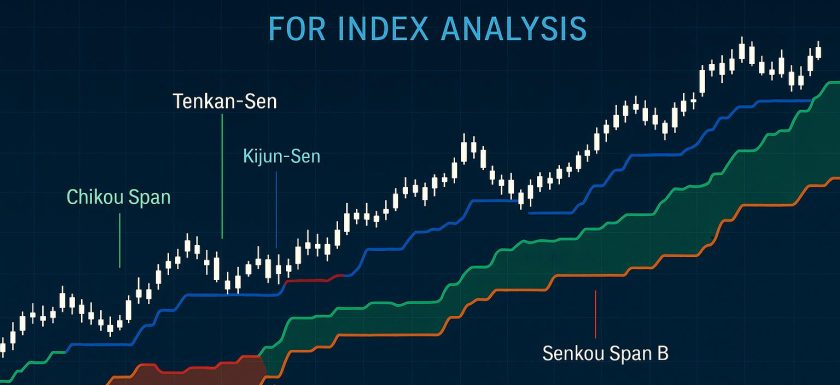

Overview of Ichimoku Cloud Trading Strategy

The Ichimoku Cloud, developed by Goichi Hosoda during the late 1960s, offers a comprehensive approach to technical analysis, providing a holistic view of the markets. This system comprises several components that assist traders in identifying support and resistance levels, understanding trend direction, gauging momentum, and generating buy/sell signals. Its ability to present a clear visual depiction of market conditions has made it especially popular in index analysis.

Components of the Ichimoku Cloud

The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, integrates five principal components:

Tenkan-sen (Conversion Line): This is calculated as the midpoint of the last 9 periods’ high and low values. The Tenkan-sen serves as a short-term trend indicator, offering insights on minor market trends.

Kijun-sen (Base Line): Calculated similarly to the Tenkan-sen but over a longer duration of 26 periods, this line functions as a mid-term trend indicator, providing guidance on broader market movements.

Senkou Span A (Leading Span A): This is derived by averaging the Tenkan-sen and Kijun-sen and then plotting the result 26 periods ahead. As a key component of the Cloud, it aids in identifying future support and resistance levels.

Senkou Span B (Leading Span B): This component is calculated as the midpoint of the last 52 periods’ high and low values and is plotted 26 periods forward. Together with Senkou Span A, it forms the Cloud.

Chikou Span (Lagging Span): The Chikou Span represents the closing price plotted 26 periods behind, providing insights into market momentum and helping traders confirm trends.

Understanding the Ichimoku Cloud

The area between Senkou Span A and Senkou Span B is known as the Cloud. This space is shaded in a way that reflects the direction of the current market trend. When Senkou Span A is positioned above Senkou Span B, the Cloud is considered “bullish.” Conversely, a “bearish” Cloud occurs when Span B is above Span A.

Signals Derived from the Ichimoku Cloud

The Ichimoku Cloud generates several types of signals that are valuable for traders, particularly in the context of index analysis:

Trend Identification: The Cloud acts as an invaluable aid for quickly determining whether the market is experiencing a bullish, bearish, or neutral phase. The size of the Cloud and its position relative to the current price facilitate this assessment.

Buy/Sell Signals: A potential buying opportunity is indicated when the Tenkan-sen crosses above the Kijun-sen. Conversely, when the Tenkan-sen crosses below, it suggests a potential selling situation.

Support and Resistance: The Cloud serves as a dynamic area of support and resistance. When prices move above the Cloud, this suggests potential support levels, while prices below may indicate resistance.

Momentum Confirmation: The Chikou Span provides momentum insights. A Chikou Span positioned above the current price indicates bullish momentum, whereas one below suggests bearish momentum.

The Ichimoku Cloud in Index Analysis

In index analysis, the Ichimoku Cloud proves extremely useful due to its comprehensive nature. Indices, which often mirror broader market trends, benefit from the Cloud’s ability to clarify these trends and assist investors in making well-informed decisions. Traders often use the Ichimoku Cloud alongside other indicators to refine their strategies and confirm trading signals. By doing so, they can enhance their understanding of underlying market conditions and identify optimal entry and exit points for trades.

Adapting Ichimoku Strategy for Different Market Conditions

While the Ichimoku Cloud is inherently versatile, its application needs to be adjusted based on the specific characteristics of the index being analyzed and prevailing market conditions. Traders often customize timeframes and integrate the Ichimoku Cloud with other technical or fundamental analysis tools to develop a more robust trading strategy.

The flexibility and depth of the Ichimoku Cloud solidify its status as an essential tool for those engaged in the technical analysis of indices. Those interested in advanced strategies involving the Ichimoku Cloud are encouraged to seek out additional resources on financial analysis platforms and trading forums, where they can explore further applications and case studies.

Understanding the nuances of the Ichimoku Cloud and effectively incorporating it into a trading strategy can significantly enhance a trader’s decision-making process and potential success in the market. By diligently practicing and analyzing various scenarios, traders can leverage the Ichimoku Cloud to achieve more refined insights into market dynamics. As with any technical analysis tool, a thorough understanding and continuous practice are crucial for maximizing the utility of the Ichimoku Cloud. Additionally, traders should remain open to experimenting with different combinations of indicators and timeframes to discover the most advantageous configurations for their trading objectives and risk tolerance.

This article was last updated on: September 4, 2025