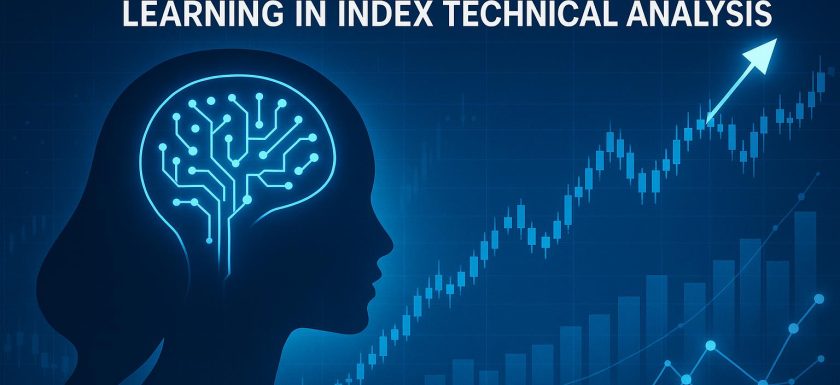

The Future of AI and Machine Learning in Index Technical Analysis

The Evolution of AI and Machine Learning in Index Technical Analysis AI and machine learning (ML) have significantly transformed the landscape of financial analysis, particularly in the domain of index technical analysis. With ongoing advancements, these technologies are set to deepen their integration into financial markets, promising enhanced analytical capabilities, refined prediction accuracy, and a data-driven approach to decision-making. Current Use of AI in Technical Analysis In the realm of index technical analysis, the traditional reliance on human expertise and established mathematical models is undergoing a fundamental shift with the integration of AI and ML. This transition is driven by the superior ability of theseRead More →